Governor Wes Moore recently announced he is moving forward with an unprecedented effort to redraw Maryland’s eight congressional district maps before the 2026 election.

Historically, redistricting occurs every ten years following the completion of a national census. With that schedule, the next census-driven redistricting would take place no sooner than 2030.

Republican controlled legislatures in Texas, North Carolina, and Missouri have recently approved new congressional district boundaries to help maintain a Republican majority in the U.S. House after the 2026 midterm elections.

As a result, Democratic Governors J.B. Pritzker of Illinois and Gavin Newsom of California, both of whom have Presidential ambitions, are pursuing comparable initiatives in their states to help secure a Democratic majority in the U.S. House after the 2026 midterm elections.

Governor Moore recently launched his own Governor’s Redistricting Advisory Commission.

About that commission, Moore has said, “My commitment has been clear from day one — we will explore every avenue possible to make sure Maryland has fair and representative maps.”

So far, Moore has appointed Democratic U.S. Senator Angela Alsobrooks as commission chair, and the following as commission members: Democratic President of the Maryland Senate Bill Ferguson or his designee, Democratic Speaker of the Maryland House of Delegates Adrienne Jones House or her designee, former Democratic Maryland Attorney General Brian Frosh, and the Republican Mayor of Cumberland, Ray Morriss.

I believe Moore has two additional unannounced goals that are driving his redistricting initiative three years into his first term.

One may be to help Moore demonstrate his commitment to leaders of the national Democratic Party that he is doing his part to advance an accelerated congressional redistricting initiative in Maryland. Achieving that goal helps Moore maintain and expand the narrative that he is a rising star in the Democratic Party and is an attractive prospective Democratic candidate for a future national office.

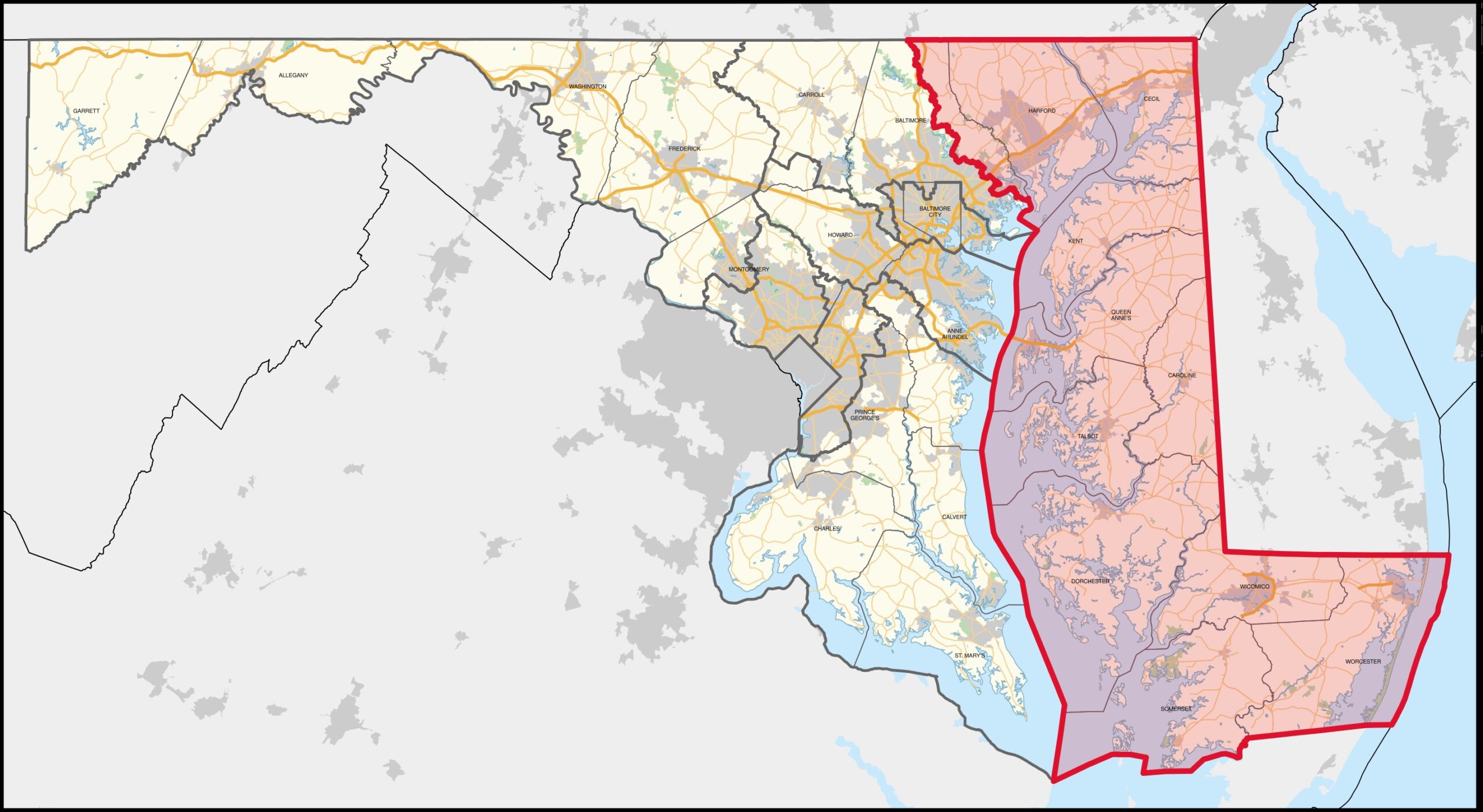

The second unannounced goal may be to redraw the boundaries of Congressional District #1 where Andy Harris is the only Republican in Maryland’s eight-member congressional delegation.

Gerrymandering congressional district boundaries in Maryland to flip congressional seats from red to blue have had measurable success. At one time, Maryland’s congressional delegation was split evenly between four Republican members and four Democratic members. Today the split is seven Democratic members and one Republican member.

Time will tell exactly what, if any, Moore’s unannounced goals may be.

Until then, I have two questions about Moore’s stated commitment to “explore every avenue possible to make sure Maryland has fair and representative maps.”

Does he know about the past efforts and results of former Governor Hogan’s 2021 Maryland Citizens Redistricting Commission? If not, why not?

For his commission, Hogan appointed nine members from across Maryland — three Democrats, three Republicans, and three Independents. No commission member was a current or former elected official with one exception. One of the Democratic commission members was elected twice as State’s Attorney in Prince George’s County. Stanford University Law School Professor Nathaniel Persily, an expert on voting rights and election law, served as an advisor for the Commission.

The commission’s final report, issued in November 2021 included the following observations:

“The lines were drawn without regard to the interests of any party or candidate and without taking into account the place of residence of any incumbent officeholder or other potential candidate, nor did we consider how residents of any community may have voted in the past, or with what political party they may be registered. The Citizens Commission believes its maps embody good redistricting principles, including compactness, minimal splits of counties and municipalities, and a highly understandable layout for congressional representation.

Additionally, they offer better adherence to the principle of “one person, one vote” through a closer approach than in past maps to population equality. We are proud that our proposed congressional and senate maps earned a rating of “A” for fairness from the Princeton Gerrymandering Project.”

At the final commission meeting, Professor Persily told commission members their efforts should be held out as a national model for the way things should be done.

It was not done in Maryland. The 2021 Maryland Citizens Redistricting Commission report was not brought to the floor in the House of Delegates or the Senate for consideration or action.

History may soon repeat itself.

While a governor can call a special legislative session, legislative leaders will control what happens or does not happen during that session. Moore has not yet secured agreement on how the General Assembly will handle his commission’s report. Senate President Bill Ferguson is strongly opposed to any accelerated redistricting initiative and to a special session. House Speaker Adrienne Jones is strongly supportive of both.

Until governors, state legislative leaders, and the majority of state legislature members agree on redistricting done right, i.e., earning an “A” for fairness, America’s voters will continue to experience gerrymandered Congressional districts.

David Reel is a public affairs and public relations consultant. He is also a consultant for profit organizations on governance, leadership, and management matters. He lives in Easton.